Overview

Use cases of our APIs in order to enable a simple and fast implementation.

Europace offers many APIs to realize your own apps, business processes and solutions for mortgage loans.

Our API documentation is constantly being developed and kept up to date. If you have any questions, feel free to contact helpdesk@europace2.de

For translation of our german domain-specific-language the glossary will support you.

In the following, we will give you a brief overview of Europace and explain the most important terms and concepts. These will be found in the further documentation.

Europace is a platform on which, as in a marketplace, supply and demand of consumer- and mortgage loans are brought together. We refer to the demand side as the Vertriebsorganisationen, and the supply side as the Produktanbieter.

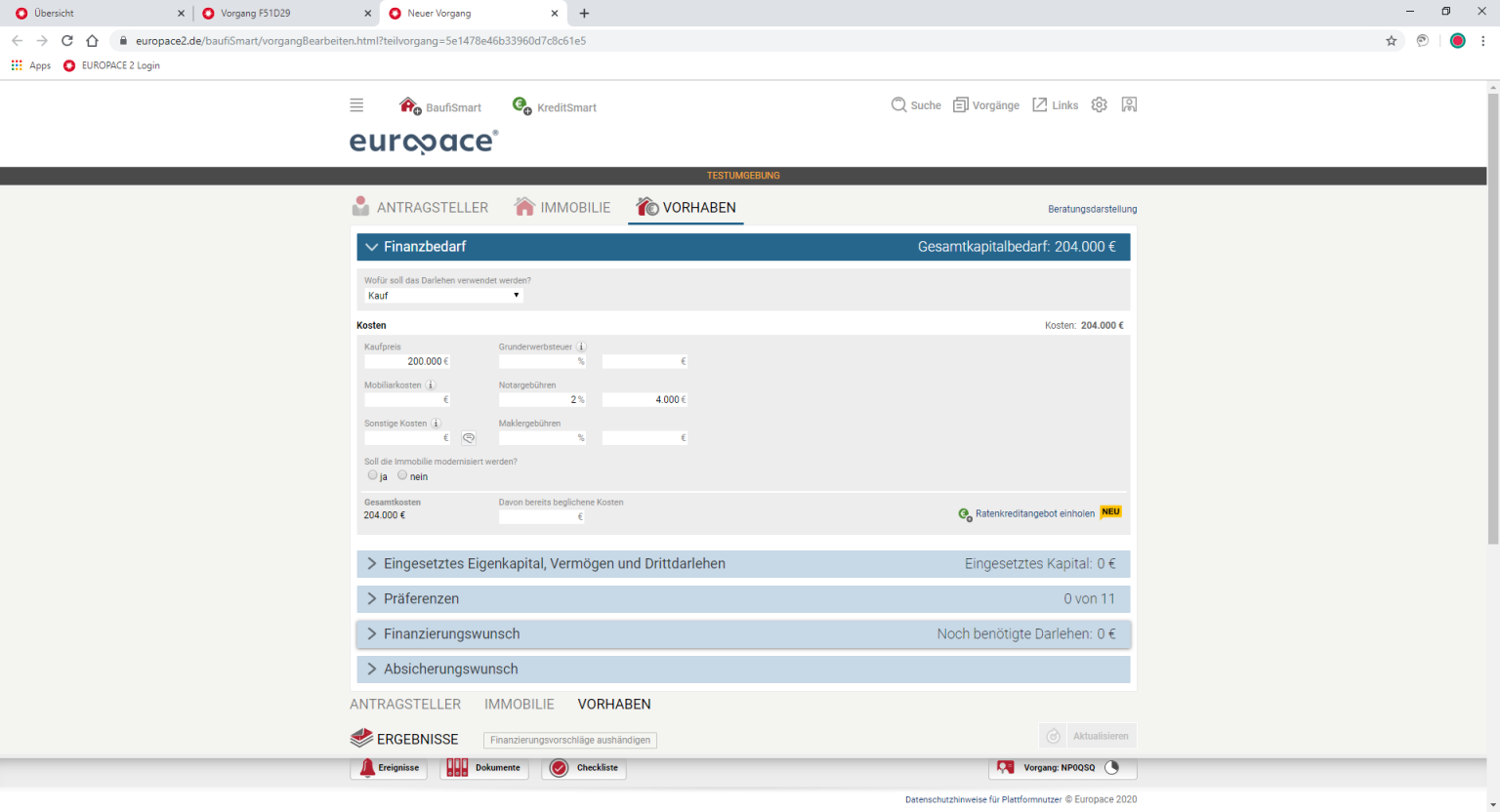

Since the advice for consumer loans and mortgage loans is very different, we at Europace have two products for this - KreditSmart for consumer loans and BaufiSmart for mortgage loans.

BaufiSmart

On the sales side, approximately 35,000 financial advisors work with BaufiSmart, brokering products from over 700 banks and insurance companies. The following steps and terms are important here:

If you want to go deeper, the Helpcenter is a good place to start.

The APIs are made available under the following Terms of Use .

The APIs are divided into the following domains:

Use cases of our APIs in order to enable a simple and fast implementation.

How to collect data and support advisory

How to get offers for mortgage loans

How to validate applications easy

How to handle documents, papers and proofs