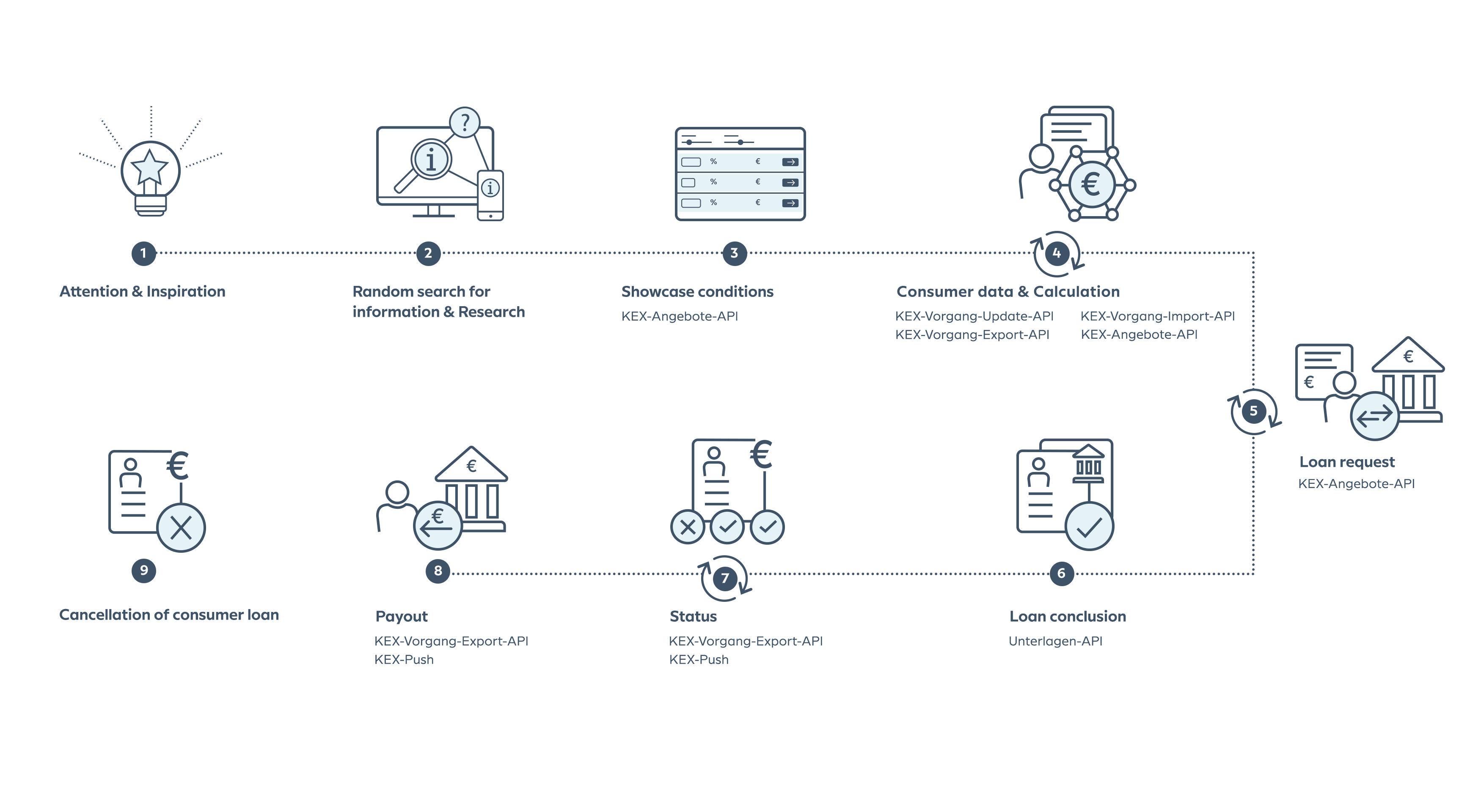

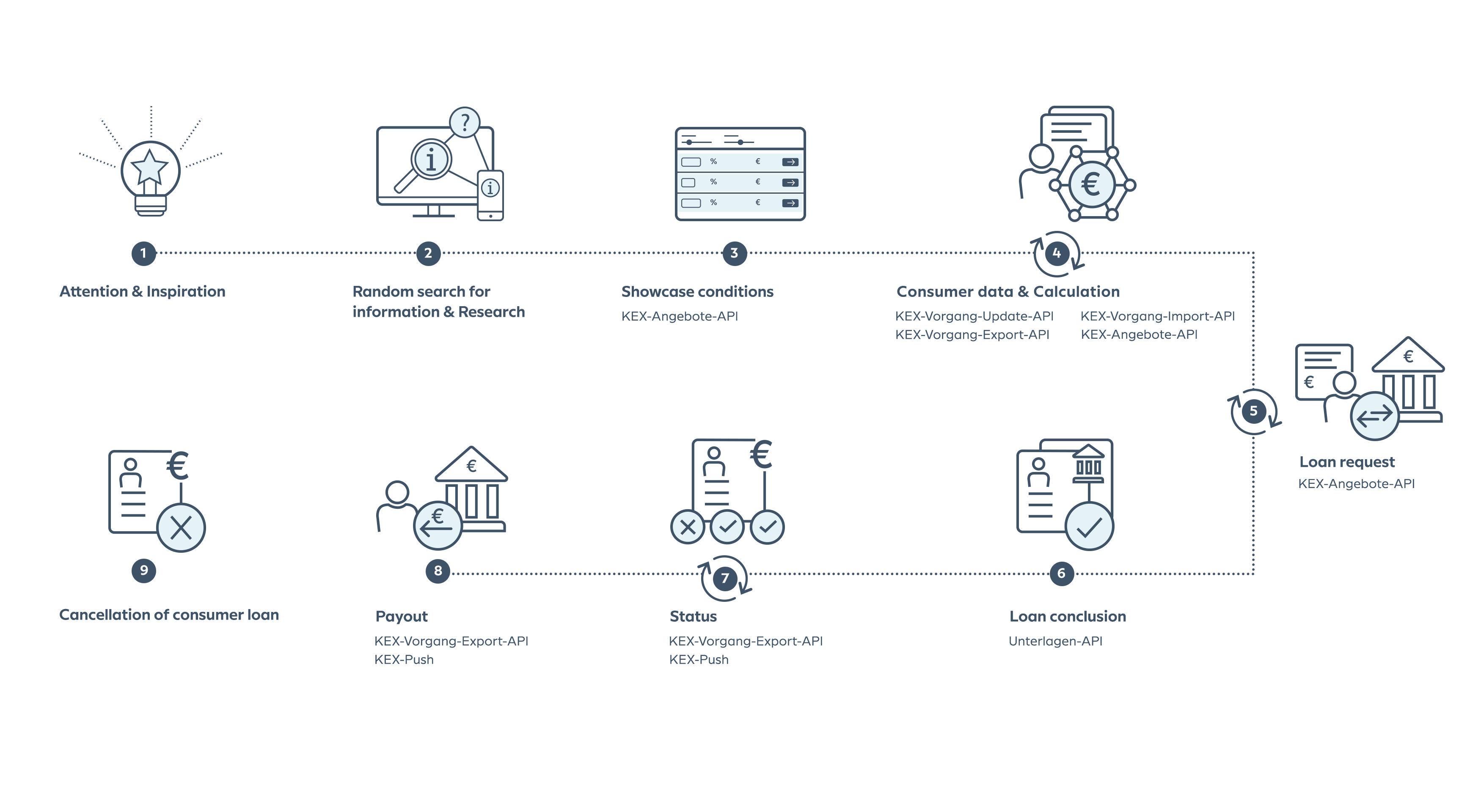

Selfservice via API: Ratenkredit as a Service

With Ratenkredit as a Service (RaaS) we offer a smart journey for the customer: from the showcase conditions over the calculation of offers up to the acceptance process and the transfer of the documents.

With Ratenkredit as a Service (RaaS) we offer a smart journey for the customer: from the showcase conditions over the calculation of offers up to the acceptance process and the transfer of the documents.